Exclusive Loan Benefits

Achieve the goal of home ownership with Mutual of Omaha Mortgage

Mutual of Omaha Mortgage is offering exclusive benefits to veterans, active duty, and their families through its real estate partnership program. When you work with a Mutual of Omaha real estate agent, you will be eligible to receive a $350-$10,500 commission rebate!

Generous realtor rebate on your home

Mutual of Omaha Mortgage's rebate program has been negotiated especially for you, our valued servicemembers (past and present and your families) with our national realtor network.

Our referred realtors will rebate you a total of 25% of the total commission they earn (22% to the Veteran and 3% to the USO). Even better, this rebate can be stacked if you are buying and selling a home.

This rebate offer does not require the client to use Mutual of Omaha Mortgage for financing. It does require the client to close with the referred Real Estate firm.

$0 down payment and lender fees

No Origination Fee, No Lender Closing Fee, Processing and Underwriting fees are waived on VA Loans. The borrower is responsible for third party fees such as title charges, appraisal charges, homeowners insurance, real estate and transfer taxes.

VA Home Loan Testimonial

MORE Realtor Rebate Examples

Veteran/Active Duty and/or their families buy a home for $300,000.

$300,000 transaction

3% commission to real estate agent = $9,000

Veteran/Active Duty and/or their families selling a home for $300,000 and also purchasing a home for $500,000 (same market or different market).

$800,000 transaction

3% commission to real estate agent = $24,000

Who is Mutual of Omaha Mortgage?

Mutual of Omaha has been helping customers since 1909. Inspired by hometown values and committed to being responsible and caring for each other, we exist for the benefit of our customers. We are recognized for our enduring legacy of always taking care of our customers. As one of the most trusted names in financial services for more than 100 years, our brand is known by millions who do business with Mutual of Omaha, a Fortune 500 company.

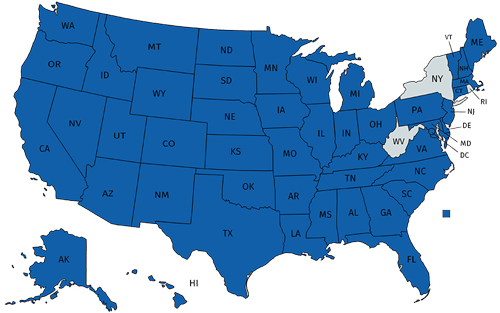

As a Mutual company our focus is helping customers reach their financial and mortgage goals. Our organization has a strong leadership team of seasoned mortgage professionals. We offer state-of-the-art technology and superior operation support, ensuring your loan process will be easy and efficient. Mutual of Omaha Mortgage has the ability to lend in many states around the country. Our Mortgage Bankers are some of the most knowledgeable and professional lenders in the business.

Mutual of Omaha Mortgage is licensed in 48 states. In the past few years, we have experienced tremendous growth in terms of the number of team members and the number of physical locations around the country.

Privacy Legal Terms Of Use Licensing

Mutual of Omaha Mortgage, Inc., NMLS ID 1025894. 3131 Camino Del Rio N 190, San Diego, CA 92108. Alabama Consumer Credit License 22123; Alaska Broker/Lender License AK1025894. Arizona Mortgage Banker License 0926603; Arkansas Combination Mortgage Banker/Broker/Servicer License 109250; Licensed by the Department of Business Oversight under the California Residential Mortgage Lending Act, License 4131356; Loans made or arranged pursuant to a California Finance Lender Law license, 60DBO93110; Colorado Mortgage Registration 1025894; Connecticut Mortgage Lender License ML-1025894; Delaware Lender License 028515; District of Columbia Mortgage Dual Authority License MLB1025894; Florida Mortgage Lender Servicer License MLD1827; Georgia Mortgage Lender License/Registration 46648; Hawaii Mortgage Loan Originator Company License HI-1025894; Idaho Mortgage Broker/Lender License MBL-2081025894; Illinois Residential Mortgage Licensee MB.6761115; Indiana-DFI Mortgage Lending License 43321; Iowa Mortgage Banker License 2019-0119; Kansas Mortgage Company License MC.0025612; Kentucky Mortgage Company License MC707287; Maine Supervised Lender License 1025894; Maryland Mortgage Lender License 21678; Massachusetts Mortgage Broker and Lender License MC1025894; Michigan 1st Mortgage Broker/Lender/Servicer Registrant FR0022452; Minnesota Residential Mortgage Originator Exemption MN-OX-1025894; Mississippi Mortgage Lender 1025894; Missouri Mortgage Company License 19-2472; Montana Mortgage Broker and Lender License 1025894; Nebraska Mortgage Banker License 1025894; Nevada Exempt Company Registration 4830. Licensed by the New Hampshire Banking Department, Mortgage Banker License 19926-MB; Licensed by the New Jersey Banking and Insurance Department. New Jersey Residential Mortgage Lender License 1025894; New Mexico Mortgage Loan Company License 1025894; North Carolina Mortgage Lender License L-186305; North Dakota Money Broker License MB103387; Ohio Residential Mortgage Lending Act Certificate of Registration RM.804535.000; Oklahoma Mortgage Lender License ML012498; Oregon Mortgage Lending License ML- 5208; Pennsylvania Mortgage Lender License 72932; Rhode Island Lender License 20163229LL. Rhode Island Loan Broker License 20163230LB; South Carolina BFI Mortgage Lender/Servicer License MLS-1025894; South Dakota Mortgage Lender License ML.05253; Tennessee Mortgage License 190182; Texas Mortgage Banker Registration 1025894; Utah Mortgage Entity License 8928021; Vermont Lender License 6891; Virginia Mortgage Broker and Lender License, NMLS ID #1025894 (www.nmlsconsumeraccess.org); Washington Consumer Loan Company License CL-1025894; Wisconsin Mortgage Banker License 1025894BA; Wyoming Mortgage Lender/Broker License 3488. Toll Free #: (816) 354-1347. Subject to Credit Approval. For licensing information, go to: www.nmlsconsumeraccess.org